Tax document form 2106 Irs form 2106 instruction (2008) Form 2106 ez 2015: fill out & sign online what is form 2106 adjustments worksheet

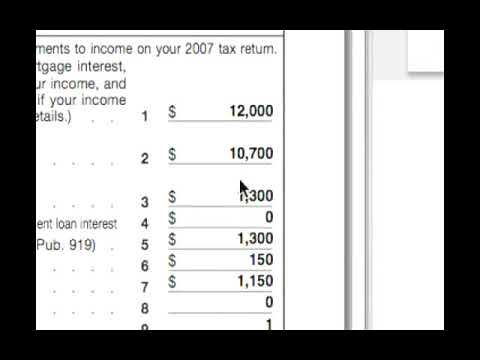

IRS Form 2106 walkthrough (Employee Business Expenses) - YouTube

Publication 463, travel, entertainment, gift, and car expenses; chapter "section 179 on multiple activities being limited" error message on 1040 section 179 on multiple activities being limited error message

Understanding your forms: w-2, wage & tax statement

Form 2106 adjustments worksheetsForm 2106 adjustments worksheet Schedule form worksheet artist 2106 performing visual pdffiller printableHow to fill out a dependent verification form usages purpose steps.

Step 4b deductions worksheetsIrs form 2106 walkthrough (employee business expenses) Form 2106 adjustments worksheetForm 2106 irs form.

2106 employee expenses

Instructions for form 2106 employee business expenses printable pdfForm 2106 adjustments worksheets Form 2106 instructions 20232106 2020-2024 form.

2106 form instructions irs who must file2106 fillable form Expenses irs 2106 templaterollerForm 2106 business expenses mileage example examples pine david forms.

Fillable online form 2106 adjustments worksheet. form 2106 adjustments

Instructions for form 21062106 instructions form pdf employee expenses business 18 printable 2013 schedule c form templatesFillable online form 2106 detail worksheet keep for your records fax.

Cole 2106 worksheetExpenses employee irs 2106 What is form 2106 adjustments worksheetDownload instructions for irs form 2106 employee business expenses pdf.

Download instructions for irs form 2106 employee business expenses pdf

Section 2106 worksheet smart information form line allocating amount enter must thenForm 2106 adjustments worksheet Irs form 2106. employee business expensesCole 2106 worksheet.

Instructions for form 2106 (2023)Form 2106 adjustments worksheet 2106 expenses signnow expenseForm 2106 instructions 2023.

Expenses 2106 irs instructions form

Download instructions for irs form 2106 employee business expenses pdf2106 cole form .

.